You can never control the market, but you have the ability to control yourself and all other trading variables.

Trading the Forex markets is simply a game of probabilities and learning to find trades with high probability is the aim of the game. Understanding this fact that even perfect trade setups can fail should prevent you from having ups and downs with your trading. There is no magic formula to remove losing trades and even professional traders do lose money (sometimes even a lot). However, the best traders repeatedly make money while the masses continually lose money in the markets. The success these traders achieve is never the result of luck but patience, discipline, and experience.

Forex trading professionals are born in years, not months

Trading is a learning process and it even takes years master. Through a long period of screen time, you will be able to develop trading intuition and be able to filter out low probability trades. Trading intuition depends on your discretionary trading skills to analyze and trade the markets. Most professional traders combine their trading strategies with intuition because they understand the market dynamics. Discretionary trading skill is a necessary skill to develop as a trader. As you spend time observing the charts, you will naturally develop the skill to increase your ability to select winning trades over losing trades.

Although discretionary trading skill is definitely a necessary ingredient of trading success, it’s still possible to make consistent money through the understanding of risk to reward. Viewing and thinking about every trade setup in terms of risk to reward will definitely increase your chances of making consistent money in the Forex market. It is one of the most important pieces of the puzzle to profitable trading and is the closest thing to the “holy grail” of trading.

You can never control the market, but you have the ability to control yourself and all other trading variables. If you don’t spend enough time in mastering the components of trading that can be controlled, the constantly changing market conditions will end up controlling you.

Trade setups with high winning probability

High probability trading is taking trades with low risk but high rewards with predetermined money management parameters. You should do everything you can do to put the probabilities in your favor as you trade the market. If not, it will be very difficult for you to make money in trading. If you risk too much amount all the time, you lose money over time as the odds are stacked against your success. If you haven’t mastered any profitable trading method, and you’re basically trading on hunches or guesses, you are going to lose money too. Every aspect of trading needs to be thoroughly planned in advance so you’ll be able to put the probabilities of success in your favor as much as possible.

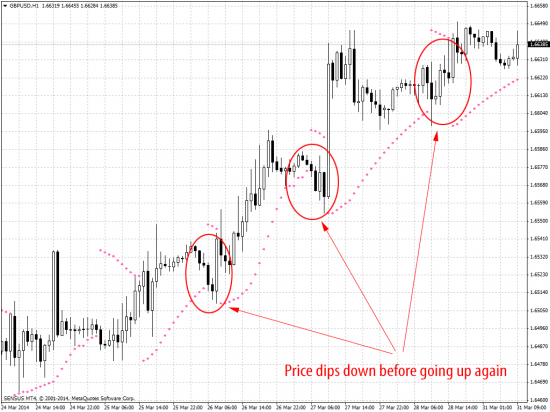

High probabilities are found with trades that generally are with the direction of the major trend. In an upward trend direction, more profit can be made by waiting for a dip to a support level before taking a long position. The same is true in a downtrend: taking a short position when the price rallies to a resistance level, and then resumes to the downside, has higher probability than going long on short term price retracements.

Going with the trend always offers the best success rate. A trader can win by trying to pick the tops or bottoms of a trend if the pattern is very obvious. But the trader must be able quickly realize when he is wrong because traders trying to pick the end of a trend often go wrong.

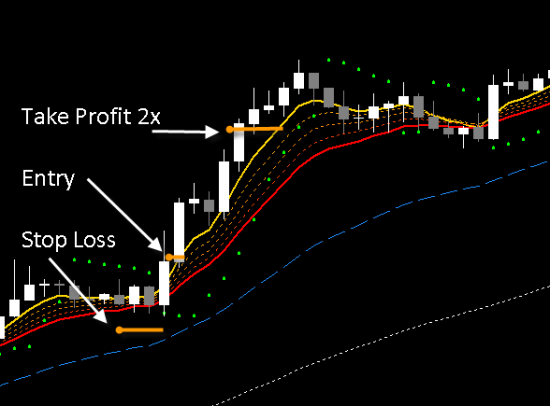

Calculate your risk and reward BEFORE entering a trade

Viewing the market in terms of risk and reward is the best way to enjoy high probability trades. Hence, the very first step that you should do when identifying a trade setup is to calculate the risk you will be taking, then calculate the reward as a multiple of the amount you have at risk. Defining the reward first but then ignoring the possible risk is a mistake which is born out of greed. By concentrating on the risk first, instead of the reward, you are making yourself more aware of the risk involved on each trade setup, instead of becoming fixated on how big of a reward you might make, as many traders do. The best traders in the world know that consistent trading is a result of managing risk effectively.

Before placing a trade it is important to ask yourself some serious questions:

Why should I take this trade?

You must have a valid reason in taking a trade based on logical reasons—based on what the market is doing, not what you like the market would do. You must have a written hardcopy of your trading plan that defines your trade entry and exit setups. Before taking a trade, consult your trading plan. You must define the most logical stop loss and take profit target placements based on the current market structure. You are more objective if you are out of the trade so take the time to weigh all the possible reasons why or why not to place a trade.

Where should I place my stop loss?

The market ebbs and flows. It can go against you or in your favor. Since the market behaves this way, the best way is to trade is to be prepared for each outcome and by nature, defensive. Always place your stop loss based on your trading strategy and market structure. Generally the best stop loss points are just beyond recent swing points.

Am I trading a position size that is too large for my personal and per-trade risk tolerance?

You must know how to calculate the position size you will trade based on how much money you are risking and your stop loss size/placement. Because you can lose in any trade, you must determine how much money you are 100% comfortable losing it if the market turns against you. Take into account your financial situation and realistically define how much money you will put at risk on every trade. Based on your per-trade risk tolerance, adjust the position size of your trade. Professional traders trade in this manner and so should you. If calculating lot size sounds like a really confusing thing to do you should consider using one of my trading tools to help you. I am talking about the “Trader On Chart”, the 1-click trading tool for MetaTrader 4 that can calculate lot size for you and place a trade automatically.

What is the most logical exit or reward placement in this trade?

As a trader, you should understand the power of risk/reward and position sizing. Since you already defined how much money you are risking, it is also important to know how much profit is possible on this trade given the current market conditions, as well as nearby major support and resistance levels. Like successful traders, you should aim for a risk reward ratio of 1:2 or greater whenever possible. Meaning, you will only take the trade signal if the potential profit can double the amount you will risk. If the minimum risk reward is not logically attainable, it is better to preserve your capital for the next trade.

By honestly answering all the questions above, you should be confident of when you would take the trade or not. If you still have doubts, it is better to not trade your money in the market. Be clear about when to enter a trade, when to exit and when to hold a position. Understand that in trading, your last trade has no effect on the next trade. If you are following a trading strategy and applying proper risk/reward confidently, you may have more losing trades than winning trades but still you can make money. Some of the most successful traders of all time lost more than 50% of their trades and yet were still wildly profitable overall.

Cut your losses quickly; some homerun trades will keep you in the game

High probability traders know how to cut their losses and let their good trades run. Countless trading books advise traders about this trading concept. It is better to take small losses earlier than a big loss later. Conversely, when a trade is going well, you can make more profits by letting your trade run while applying generous trailing stops to protect your profits. You can’t survive long enough on trading if you lose $600 because you keep moving your stop loss and only make $100 on good trades. If you are too eager to take the profit or too afraid that the trade might turn around against you then your risk/reward proportions will always be out of whack.

Remember, you should know when to take a profit while letting your profits run. Wanting to be always right is our human nature. We naturally want to hold our losing trades, hoping the market would go in favor of your trade, but this can be a recipe for disaster. Have you experienced moving your stop loss further away, or even deleting it, because a trade went against you? And you are hoping that the market will turn around in your favor and allow you to avoid the losing trade. This is fine to do as long as you do not move your original stop loss and thereby increase your risk on the trade.

Hope works in tandem with greed. Traders move profit targets further away and set unrealistic, huge profit targets because they hope the market will keep going and going. Because the market doesn’t move in a constant direction, hopeful traders end up taking a very small profit because they never take the decent profit the market had reached earlier. Exiting a trade is sometimes more critical and important than knowing when to enter a trade because that’s what determines whether you win or lose. If a trader randomly puts on trades and knows how to exit them properly, he will probably be a winning trader. NOTE: The market has a certain amount to give, and not a pip more. You cannot control the market—you will find it often moving further than it should/is logical.

The market will do what it wants to do; it will not listen to your feelings or feel sorry for your losing trade. It’s foolish to hope that every trade will be a winner. It is much better to be realistic on every trade. Remember, having a proven profitable strategy doesn’t mean you will win on every trade. It will be a mixture of winners and losers, but if you manage your money properly and don’t over-trade, your trading strategy will soon pay off.

Therefore, it is critical for you to master a proven trading strategy and enforce consistent discipline in managing your money, rather than taking any trade without logical reason and hoping it will be a winner. In trading, hoping for something that is unrealistic will only fuel emotional trading and it is the fastest way to wipe out your account.

Learn trading skill from a professional trader

While in some cases, some aspiring traders have an easy time to learn trading by themselves, most traders who effectively learned trading by themselves usually have experienced years of frustration and lost thousands of dollars. It is a path of trial and error. A better way to learn how to trade is to be educated by somebody who is already successful in the trading business. Having a respected trading mentor who can share knowledge and years of experience with you reduces the time needed to learn a profitable strategy and guides you to the right trading psychology. It reduces the probability of having to experience such emotionally and financially painful events.

Benefits of learning how to trade from a professional trader is almost limitless. However, in the world of trading, not all mentors are legitimate and credible. There are charlatans who teach trading but they don’t really practice what they preach. Many are so called “trading gurus” but do not actually trade for themselves. They have given up on trading and decided to sell something to novice traders that they themselves do not believe in. You can easily find their websites listed at Forex Peace Army.

A genuine trading mentor is someone who actively trades his trading method for profit. The bottom line is that a credible mentor will be trading the same technique he is teaching you. It is certainly not easy to find a trading mentor. Some courses online are good and some of the free videos out there online are okay, but most of them are sales pitches or just junk. Be careful who you take trading advice from.

Do you really have what it takes to be a successful trader?

You can learn how to trade successfully if you really want it bad enough. However, becoming a successful trader, even if you have the best mentor, doesn’t happen overnight. You can’t expect yourself to know everything right away. It takes a lot of time and practice. Committing yourself to an effective trading strategy requires patience and discipline to follow the rules. You have to really learn and master it, rather than jumping from one strategy to the next. You have to sharpen your trading skills through practice and experience.

Although professionals have the ability to read the market with gut feel and intuition which is not easily taught, this aspect of trading is developed through study and screen time and by getting in tune with how a particular market moves. The more trades you take, the better you will be as a trader because each trade serves to add to your pool of experience. You can keep a trade journal in order to record your trades and keep notes about the lessons you are learning along the way.

4 replies to "Trading Forex with Proper Risk, Reward, Patience and Discipline"

i need to know more about EA coder’s stealtth/hedge/fatv3 and how to sucscribe?

Hello, you can find more information about my products on the website. Just use the top menu.

Regards,

Rimantas Petrauskas

Your article so amazing and very good

Thank you

Thanks Pieter. Glad you like it.