Just like in life, some people seem to have an easier time doing well than others. Have you noticed that it seems like some people are just naturally successful, while others struggle through life consistently? This post was shared through lessons from a friend of mine who has been trading Forex for about three years now. He has tried everything from robots like FapTurbo.com and Forex-MegaDroid.com (not affiliate links) in the beginning to signal services to semi-managed forex accounts to more robots. He has also trading manually for many years, with only spotted success at best. He has also spent thousands of dollars on different trading courses, most of which were not applied or were not applied correctly.

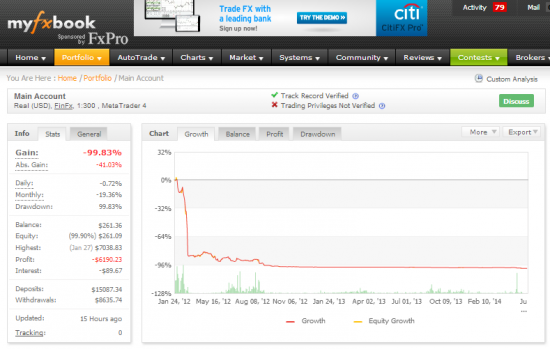

Here is a screenshot of his main live account verification through Myfxbook.com.

That’s kind of discouraging, isn’t it? You can see that his total deposits have been just over $15,000. Due to running out of money in other areas he was forced to withdraw funds along the way to the tune of $8635 as you can see in the column on the left of the image above. But the numbers in red are the most shocking. You can see that his profit is a total of negative $6190.

“Lessons are repeated until they are learned.”

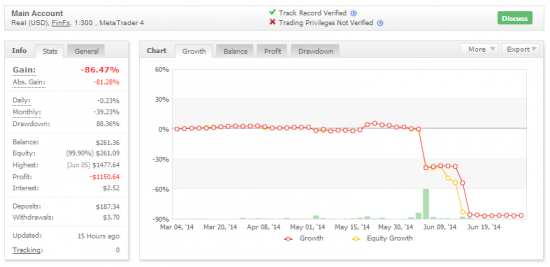

Even if we look at the most current three months on his account we still see discouragement and no apparent progress. Well, progress in the sense that there are more lessons learned but not to forward financial progress as he would have hoped.

The mistake here was in signing up for a signal service over at mql5.com which had been successful in the past but when my friend joined it there were two gains and then a series of painful losses and drawdowns. This would be discouraging to anyone who had faced failure for several years in trading.

Let’s start taking a look at some of the mistakes my friend is made with an eye for appreciating the lessons that we all can learn to improve our own trading businesses. By the way, I am not writing this article to pick on my friend or one of my fellow traders, but this rather is at the wishes of my friend who wanted to share his experiences for the sake of helping others. I think we can all learn a lot from these experiences that he’s had.

Mistake #1 – Not thoroughly applying what was bought or learned

This is a common problem that happens with many traders. They purchase something and then just put the course on the shelf. You cannot learn anything from a course that you don’t go through. Some courses may not be very good. Sometimes it is hard to tell online what is good and what is bad. We have to buy something first to have it arrive at our house only for us to realize that is not a very good system. Sometimes we can return it and sometimes we can’t. Oftentimes you can tell a stinker of a forex trading course as soon as you start into it. When something so bad, there’s often no need to continue, and you’ll simply do your best to get a refund.

Other times, you order a course but you do not complete it. This can really be a dangerous thing. After all, you have invested hard earned time and money into purchasing this system, but you never even get to applying it because of procrastination, laziness or distractions in life come up. All of these things can happen, but they will not make you money. A business trainer once told my friend, “You can either make money or make excuses but you can’t do both at the same time.” And in many ways this is true. If you are always blaming something externally for your failures then you may not get far. Those who do get far are often the ones who do not let obstacles or roadblocks get in their way. They are willing to continue on after repeated failures.

“Success is failure turned inside out”

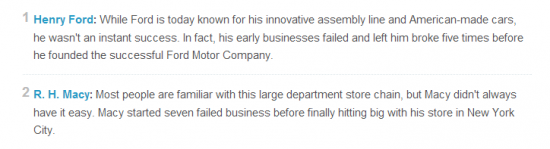

Let’s look at some of these examples. I want to refer you over to a very nice article that outlines 50 very successful people who at first failed. A large number of these people are either multimillionaires or billionaires, or were when they were alive. Most of these people struggled for years and not days or months. After all, success is not easy. “Don’t ask for life to be easy, ask for it to be worth it.” Is a quote that my friend learned from business trainer Dani Johnson and it seems very appropriate for what we are talking about here. After all, because success is difficult, most people won’t ever get it. You have to be one of the few if you want to achieve a high degree of success.

So my friend has struggled, like a lot of other successful traders have as well. He has good experience from all the failures, so we don’t want to say that they are total losses. After all, that some people learn—by making mistakes. Oftentimes the more mistakes you make the more chance you have of being successful in the future because you have learned so many lessons. Those that do the best are often the ones who take the most action, make the most mistakes, and then apply the lessons that they learned from those mistakes.

I think it would do you a lot of good to go read this article about the initial failures of very successful people. As you can see it’s a very long list of people who achieved great success in their lives, but the year before they started hitting success they probably felt like mere determined failures. I bet they were discouraged a lot of the time. But they had something in them that kept them going. They continued on and eventually they found success. This is a very common theme that you notice out there in life. The ones that make it are the ones who keep going.

Mistake #2 – Not being in at the right times

Maybe this is happen to you before… It happen to my friend where he joined a signal service at just about the worst possible time. The signal service had been doing well for quite a while and with no drastic drawdowns in the recent history. But just days after my friend joined the service it tanked and went very nicely negative.

My friend was trading too aggressively, but not all that aggressively given the prior history. This was something new and a drawdown that no one could have seen occurred.

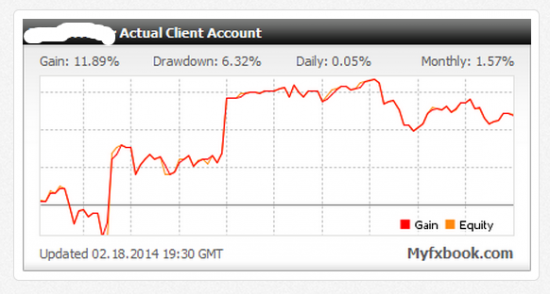

This is the segment of time in my friend was here trading with the signal. You can see the growth of the past many months. Very consistent and very predictable and then BAM, a large drawdown. The previous drawdown had been about 25%, which my friend was calculating when he decided on his risk appetite for trading this signal. But this drawdown was 50% and it wiped out 80% of my friend’s account, which you can read about here.

Is this something that we can learn from? It’s hard to say that most of us would have done things differently. After all, just look at the performance record the previous six months on this trading system. Extremely consistent returns is all that you will see. It is a hard lesson but one that should make all of us wiser. If you’re going to go after such a phenomenal return, but one also that carries great potential risk, you had better do it on an account that has enough money, has plenty of leverage, and is not your primary trading income source. You would have been better off starting a new live account, even if just $200, and trading this signal if possible. And if the risk tolerance would not allow with such a small account then just pass on the opportunity. The signal service was rather inexpensive costing just $20.00 per month but with trading it on a small account the chance of even getting to breakeven on that subscription amount is difficult and could take many many months.

Mistake #3 – Not testing with consistency

This relates back to the last example also, where inconsistency will skew your trading results. My friend now looks back on this signal service and he can see that, while there was a large drawdown, the signal provider has not recovered and the balance in the account as reached a new high. My friend lost out, however, because he could not continue trading this signal (nor did he want to after such pain). If this signal were traded for a longer time, with more consistency, the results might have been very different over the long haul.

A good lesson here is that if you are going to trade such a service/signal, or even a robot that you are working with, start a dedicated account just for that one signal. Do not trade anything else on it, but only trade the signals from that service. Put that new account on a VPS (server) account and then don’t touch it for 6 months or a year. Let the service do the work and do not interfere with its performance.

Mistake #4 – Tampering with trading funds to pay bills or inconsistently depositing funds without a plan

This gets back to your overall financial management. If you don’t have a steady job and are trying to trade full time in Forex but yet you don’t have a large account (or an account big enough) then you’re going to run into frustration, like my friend has. You saw in the beginning how he had deposited a good amount of money into his trading account, but yet had to withdraw about 50% of it. This led to the accounts decline as well. It wasn’t just from losses from the trading that took the account down, but it was from having to withdraw the money to pay a regular bills.

This is a very difficult way to try and succeed in Forex. Generally, the money you trade in Forex should only be money that you can afford to lose. Also, it should be money that you can afford to risk, which means you don’t touch it for a number of months. You should allow your money to grow. If you find, through testing, that a signal service is not good then you can and will get rid of it. But the greater danger for most people is to quit something that is still working or to interfere with that success by tampering with the account. This might happen because you’re taking other trades or trying to trade manually at the same time that you’re running a signal service or running a robot, but all these things contribute to a poor way of managing a trading account.

Mistake #5 – Getting scammed by bad products or services

Sometimes in Forex, the losses are simply not your fault. While they are not your fault, they are your responsibility. You cannot stand back at the end of your life, never having made money in Forex, and say that it was because you lost money with XYZ Signal Provider. While you may have indeed lost money with a certain signal provider or trading system, in the end the failure rest with you. You are responsible for your own money and for taking care of it. If the money is lost, it is still your fault regardless of the reason for the losses. For example, if you never put your money into Forex trading, then you would still have it today (we’re talking about a failure/loss in trading here) but because you put the money into a forex account and lost it, it is still your mistake and failing. The decision is yours and no one else’s. Even if you were led astray by a good sales person or a sales pitch that turned out to be a scam, ultimately the decision was still yours—no one held a gun to your head and forced you to trade forex.

Here is an example for my friend. You’ll see in the image below that the track record in the first half was was a positive, but in the second have you see the account began to tumble and then the tracking on this account would shut off (presumably because it wasn’t doing too well). This service was run by a previously successful hedge fund trader who started to experience great losses. My friend joined this trade alert service at just about the worst time and experienced losses. There were some initial errors when they started up with the signal copy service and then after that there were some bad trades. It seemed like no matter where my friend turned he would run into more losses.

But still he continued on. The next series of lessons came from another signal service, and this one much more of a genuine scam. Take a look at these images below and see what you think.

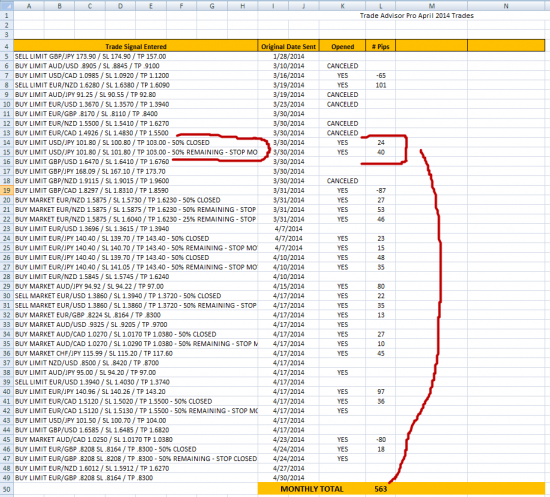

So you can see what this website is promising. My friend was scammed out of more than $700 by this website. Take a look at the image below to see one of the ways that they gamed people.

As you can see in this image, the total reported pips come to 563. This is not something that my friend could pick up on as he was a relatively new trader when it happened, but if you see a statement and a trading system that uses partial closes, the results in the end will be difficult to decipher unless you are able to see a capital balance.

This is how my friend eventually found out what was going on. He discovered a live money account somewhere buried in the members area which revealed that the master account was steadily losing money, even though the pip count for that account continued to rise. They were playing people for suckers focusing on how many pips were being made. It’s easy to make pips in an account. If you start off with a full lot size trade and then close 5 partial positions of 0.1 lot size at 20 pips each then you have 100 pips. But then if the second half of the position goes down for a loss of 30 pips then you can say, in this sinister method of accounting, that you are up 70 pips in the account. But do you see that you would have lost real capital while the pip count still showed positive.

This is just another example of where you need to be very discerning in the Forex business. After all, the Forex course/signal/training marketplace is chock full of marketers who want to take your money and deliver very little of real value. Can you remember the first indicator that you bought from a flashy sales website? It looked pretty good and beginning but then when you found out that the indicator repaints 10 bars and their screen shots from the sales page were based on the same, you realize how much of a fool you were to purchase and the first place. You try to get your money back, and if you’re lucky you do get it back. Lots of people get scam to in such ways.

In the coming weeks I will write more about this scam of partial close where signal providers try to gain as much pips as possible, but they still end up losing money in the account. For new traders this even might sound something confusing or funny, but I will explain how this is done so you should know what to look for.

But what can we learn overall from all these mistakes?

There are so many lessons here it is hard to say which is the most important. Those to test new trading systems very slowly and I very diligent with their research will tend to do better in this business than those who simply run out with lots of money and spend it all on 10 different trainings but never apply what they learn or never buy the right training to begin with. Forex can be a very challenging and very difficult business. Markets are constantly moving in shifting. They go through times of great trending, but they also go through many times of flat price movement. Because the Forex market is difficult to trade, even for experienced professionals with 10 years of experience, it is that much more difficult for those of us who are less than five years in this business.

And because the Forex market does evolve over time, we see these days there are less long-term trends like there used to be and price often jumps around much quicker than it did in the past. One of the signal provider’s that my friend to subscribe to have been very successful in the past, but as of the last couple of years he struggled greatly because his trading style was no longer profitable in the markets the way it used to be. This is a sad and confusing thing, and it’s another thing that is hard to identify when you’re in the middle of it.

Perhaps the best thing you can do is continue to latch on to that which works for you. My friend sometimes had trading systems that were successful, but he would abandon them in favor of something better. Or at least that looked better on the outside. Inconsistency was something that plagued my friend and it’s something that might be plaguing you as well. If you’re inconsistent then the most important thing you can do for your business it to force yourself into being consistent. Pick one thing and stick with it. Let me leave you lastly with this Confucius quote…

“The man who chases two rabbits loses both.”

Does this mean you can’t work on more than one thing in trading? No, but you must ask yourself how well it is going and if you are sacrificing one thing for the other. Remember that it is the laser light and not the sun light that can cut through metal.

6 replies to "Lessons From Forex Failures Will Often Teach Us The Most"

Good article Rimantas, and so true. Been there and done that with most of these mistakes so I know exactly where your friend is coming from. It is hard to put your trust in other people’s trading skills, even when those other people mean well and are not out to rip people off. You just don’t know what is going to happen next week in their own personal lives, which will not only affect their trading but also your trading. Nowadays, I feel you have to either trade your own system or EA, and take full responsibility for your own trading. Treat it like a business also, and be prepared to take your losses when they present themselves. It is not a get rich fast thing, but more slow and steady as she goes thing. I wish your friend well in the future with his trading…..cheers.

Jim, I totally agree with you and thanks for your comment 😉

Regards,

Rimantas Petrauskas

I fell for this trick sometime back in a signal provider website but now I know better.

(………….have lost real capital while the pip count still showed positive.)

this is very enlightening.

Hi, thanks for sharing. I am sure there are tens if not hundreds of thousands of us who suffered of similar scams.

Regards,

Rimantas Petrauskas

As usual. Excellent case study. Funny you never recommend your signal?

I think the first step is the fact that when starting should have just traded with only $100 and see if it turns 100% before upgrading his capital.

I lost a lot but is money I can afford. But after 6 years I’m still trading 3 digit account. Only in 2013 I manage to to turn $100 to $213. In less than 10 months.

I was hysterical. Then in January 2014. I turn $1000 to $1800.

I was excited. I thought I was over the moon. I thought then I can easily make more then 50% profits per month and quit my offline business by next year.

My ego was inflated. Then shit happens. I up my capital by $2k. Then I proceed to bust 2 accounts in Feb and then in April.

The same technique that work in 2013 because my position is small I didn’t have fear and I don’t care because it is an amount I can easily recuperate with my offline business.

That same technique work in Jan 2014 because I was aggressive and the market was right. At last with so much winning my ego was polished. My eye was blind.

U believe your friend has the same effect but the first fault was not learning to trade despite the failure.

This year 2014 is my 7th year of trading Forex. And I’m still at it. Because I believe I can turn it around. I’m better then the folks who dump $50 to few hundreds and lottery tickets.

Thanks for the post it is really reminder than you have to take control of your life because disappointment is everywhere and the Internet has made it reachable to everyone.

David, thanks for sharing your story. I agree that Internet has made disappointment reachable with so many scammers and get-rich-quick schemes.

Many look at Forex like it’s fast money and even those who think they do not look into Forex as fast money, they usually start to do so when it comes to an ego and greed.

Good luck with your trading! I hope one day your results will be great and you will share it with us.

Regards,

Rimantas Petrauskas