Many people across the world fall into the traps of scammers and end up losing money in the hands of scrupulous scammers. If they had a better way of identifying the scammers earlier in advance, they might have escaped the pitfall. The forex market has been a soft spot for many scammers that are constantly coming up with new and lucrative scamming methods that are appealing to most people that end up on their trap.

I give you these five most basic steps to help you identify forex scams used by providers of Expert Advisors, indicators, and trading signals.

1) How did you find out about the product?

This is usually the most basic step and the first question that should come to your mind. The means by which you arrived at your information greatly dictates whether it is legit or a scam. For most scammers, their emails are generally saved as spam email or in the spam folder. So trying to get the juicy unbelievable emails to work is really attracting trouble.

Another way the scammers thrive is by giving false advertisements in other websites. They sugarcoat their ads in a way that newbies in forex might be tempted to try out.

For instance, websites that may be supporting mp3 downloads and have a lot of advertisements and you see an add promising returns of $3,000 from an investment of $250 only if you buy their software, which in many cases that software never works.

It would be insane if you believed that their software would work out. Though in some cases they might even have a video to fool you of how someone else made that kind of money, but unfortunately it is not the true unfold of events.

Reputable websites and magazines, on the other hand, have very few ‘too good to be true’ ads and they are basically the preferred and used over time websites. They have trustworthy interfaces and they are realistic in nature. You never expect such unbelievable deals or offers that won’t work for you. It is ideal if you would stick to only reputable websites.

Recommended read: Awful Forex Frauds and Scams Every Forex Trader Should Avoid

Of course, I should also mention that “unrealistic” promises might also be reputable, but because it’s something new and you are not aware of that it might sound unrealistic for you.

Such an example would be my promise that you can create 1000’s of fully automated Forex trading strategies per day without any programming knowledge and spend only several minutes. Sounds unrealistic, isn’t it?

Well, it does sound normal for me, because it is really possible with the help of special software that generates randomly assembled strategies automatically. It then tests them on a historical price data and shows you only the ones that have a good looking backtest so you can work on them further.

For someone who has still stuck programming automated strategies for MetaTrader and coding them in MQL4 programming language, such promise would look like unrealistic, because they usually create only one automated strategy per week.

We actually do a software demonstration in our weekly webinars and you can register for the next webinar here.

2) Are there only backtest results?

Backtest results are another catch for vulnerable traders. Most traders will fall victims of this trap because of the belief that numbers and statistics don’t lie. But suppose the numbers are manipulated to depict a certain result, will Einstein not believe?

That’s the catch with the backtest reports. The backward test conducted by the scammers will only show one side of the coin and will keep a secret the other. It is only after due diligence and proper scrutiny that you will come to light as to whether the backward test work or is just another holy grail of fleecing money from vulnerable traders.

So what should you do to verify the authenticity of the backward test? This should be followed by a mandatory request to see the verified results of the same strategy on myfxbook.

Myfxbook is the most reputable online catalog of live and demo accounts that replicate the trades and statistics of an account in real time. So from myfxbook, you can verify whether the trading strategy is an illusion or whether is workable. In other words, any automated EA can show good backtest results, but if it fails in the forward test trading on a real money account you will see this on Myfxbook. If there are no forward test results verified on Myfxbook it is most likely the strategy does not work on the real account.

An excuse for not posting trading strategy results on Myfxbook because it’s too difficult sounds silly. It takes just a few minutes to do this and it is really easy even for not tech-savvy persons, especially when Myfxbook gives simple to understand instructions.

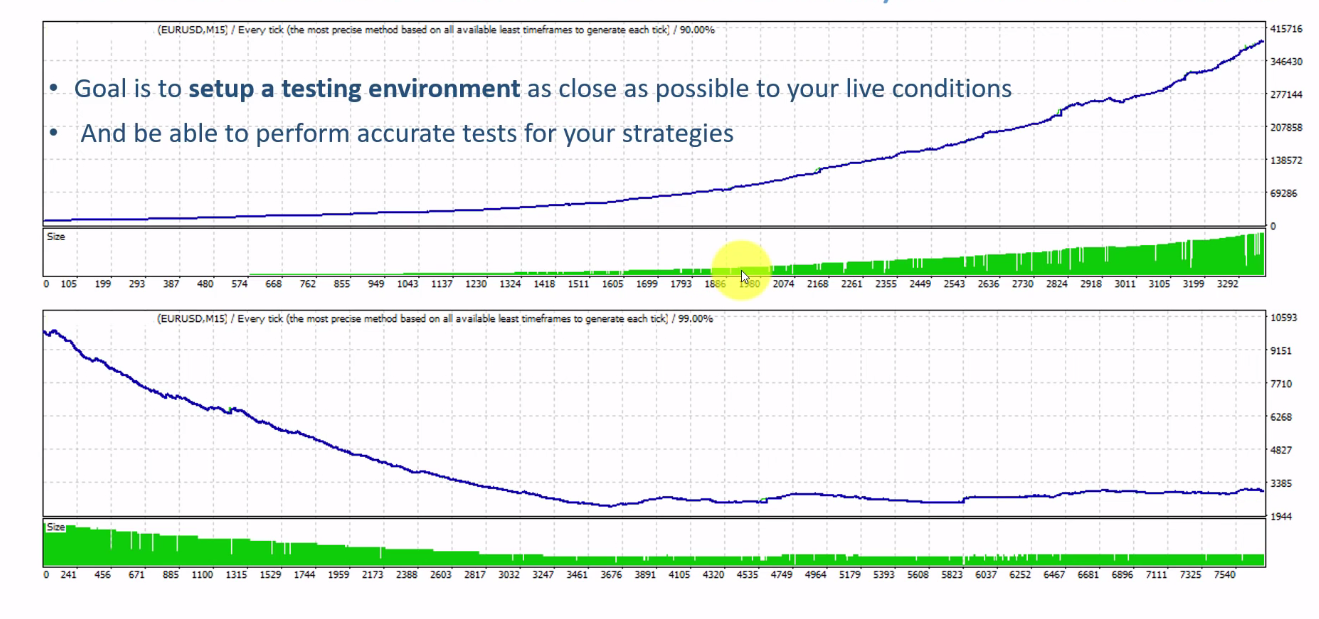

And speaking about backtests again, to even get a better look at the backtest, insist on the robustness test. The robustness test will ignore the perfect situation that the backtest might have been subjected too.

The robustness test can be a simulation of say 500 to approximately 1000 simulations of the same trading style but subjected to different parameters. This will give a true picture of the MT4 Expert Advisor or trading bot that you are about to invest in.

Well, it is required of you to know that when the deal is too sweet, think twice and this should also be applied to the forex niche.

To prevent further menace, not everyone should be trusted since some brokers are fond of taking advantage of this loophole. It’s not new in forex to learn that a broker was a scammer before he shut down.

Recommended read: Tricky Ways Many Forex Brokers Cheat and Steal Your Money

They will post hilarious videos of a new cash cow robot that works across all markets and display an impressive ROI, and by saying impressive I mean not less than 1000% return. By the fact that most traders are in the forex market for profits alone, then saying no to such Expert Advisors and bots from a broker is almost hard to resist.

Yes, numbers don’t lie but try to dig deeper to establish how the numbers, the statistics and how the profits were arrived at. By doing so, you will be safe from the purchase of a bogus MT4 Expert Advisor.

As a matter of fact, it is better to devise your own trading strategy because these days you are not required to have any programming skills to be able to create an Expert Advisor. By doing so you will be able to create and customize a strategy that works for you.

If you don’t know where to start I recommend starting with the “Trading Strategy Launch Framework”. It is proven to work and to my knowledge, it is the best method available today for retail traders to creating fully automated algorithmic trading strategies without programming and spending only one hour per day.

3) Are Myfxbook results public or are they private with hidden data? Do not trust hidden results.

Myfxbook gives credibility to a lot of traders and investors in the forex market. Well, but as the constant growth of credibility of this source widens so does the creativity of scammers expands too.

One way unscrupulous traders are making a kill out of the myfxbook is by hiding data. Unsuspecting traders will be lured by impressive gain results that are displayed on myfxbook yet the owner of the robot will not display the equity curve.

Anyone looking for the credibility of a given Forex trading robot, trading system or copy trading signal service should request the equity curve report because it tells a lot. You can get a tip of the drawdown, the ROI, the time period which the Expert Advisor has been on execution and so on.

The question is why should the seller of a trading strategy hide such important and vital information from you? Isn’t there something fishy when such information is withheld from you?

Yes, because part of what was used to arrive at the figures is by trading using the martingale trading strategy, a strategy probably worse than the Russian roulette.

Speaking about martingale trading strategies again, these are usually easy to be created on MetaTrader 4 or MetaTrader 5 trading terminals and many programmers choose this trading algorithm to come up with better looking backtest results. Such trading method is very risky and never reliable.

Some of the trading results can also be hidden because there are spikes and trance in the equity curve, a thing that any seller would do whatever it takes never disclose to anyone. Or even probably there are 100 trades that are in execution which even a new trader on Wall Street wouldn’t consider doing because it is so much against the rules of financial success.

So what you will be left with are only the impressive gains that will be shown and the rest of the information such as stop loss, lots, and leverage hidden from you. This will make it impossible to calculate the risk-reward ratio which is a basic investment analogy.

Making profits in forex involves manipulation of risk and reward. Why should somebody show you only the reward and not willing to show you the risk?

Why should you buy an automated or manual trading strategy for its successive profits and yet you are reluctant to understand the level of risk that was assumed to reach the profits?

There shouldn’t be any information from Myfxbook that should be hidden from you period!

4) Do you get investor password with IP address? Don’t trust it.

Investor’s passwords that come with internet protocol address (IP) are another trick that scammers use to reap from unsuspecting traders. An IP address from a reputable broker may be fine, but that shouldn’t be the basis used to scrutinize the broker.

A good broker should be regulated by a reputable financial body. If an IP address is obtained from a broker who isn’t regulated, it should be treated with extreme caution. Most brokers to maintain their credibility they will give different server names from the drop down of the server list. Therefore you will log into the trade server that corresponds to your account.

Rarely will an established broker give you an IP address to connect to a server. Therefore, such gimmicks remain to scammers and a matter of fact you should raise the red flag once you spot such a scenario.

The manipulation of the trade results happens because the scammers know that once you log into the trade server there are already trades that had earlier been executed with almost perfectionist results and therefore once you log in you will be impressed by the results.

As a matter of fact, it may be that the trade server is not connected to a real Forex broker. In other words, you could be connecting to some fake MT4 server. If a product seller is a reputable company in the forex industry, therefore, the question should be; why should they direct you to connect to different servers which even any forex broker don’t use?

Doesn’t it sound weird or a ploy in a pipeline to get rid of your hard earned money? The rule for this fourth rule is simple why should a seller use a different server from the mainstream server?

If a trader connects you to a different server by the IP address, don’t believe and don’t even proceed. Save you time and effort and move on to another service provider.

Recommended read: What the heck is up with all these forex scams?

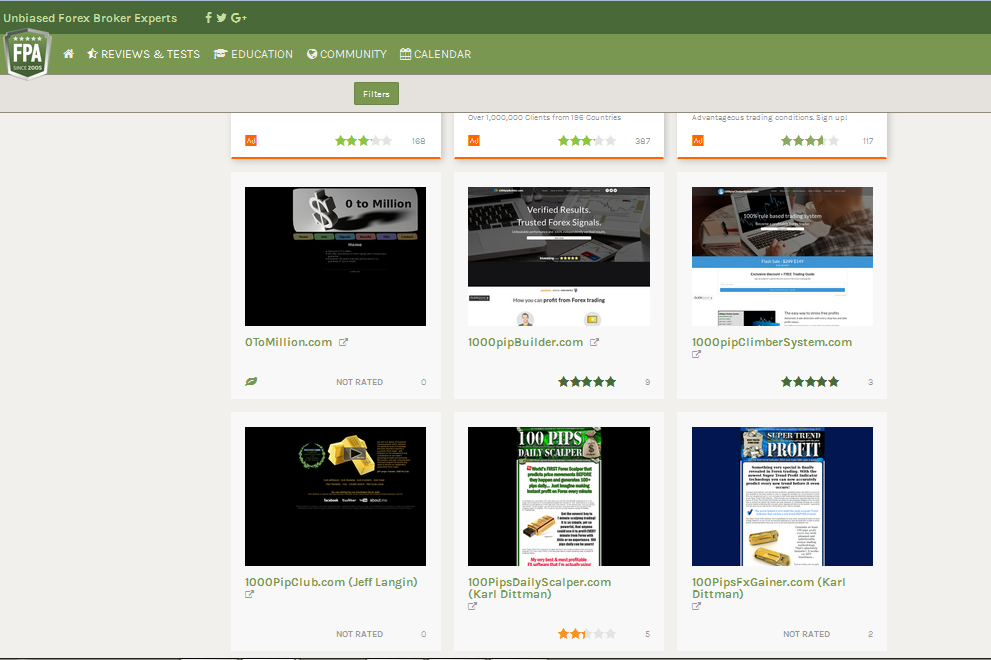

5) Check reviews on ForexPeaceArmy.com

Just as reviews help in making an informed decision whenever doing an online purchase, in forex reviews too help in making informed decisions. One credible place where you can get such information is on ForexPeaceArmy.com.

As at 2015, over 300,000 traders had read 13,000 broker reviews from forexpeacearmy.com. This tells you the credibility of this website. Any rogue broker gets exposed and the same applies to bogus expert advisors.

From this website, you will get a true picture of any Forex product or service from reviews of other traders who might have tried it. On this website, you will get a huge list of forex scams that have been exposed and you can easily correlate a seller who has been listed as a scammer.

Part of the scrutiny with reviews is that the reviews should sound natural from traders since some of the scammers create pseudo accounts and post fake positive reviews about a broker, a robot, a trading strategy or copy trading signal service. But this usually does not work on Forex Peace Army, since it is close to impossible to post false reviews there thanks to their strict rules and special protection system from fake reviews.

You should read the reviews in detail as part of your due diligence before buying a bogus Expert Advisor or any other Forex product. After all, it is your hard earned money and you need to get value for money whenever you purchase anything.

Conclusion

As the forex market grows and gains interest across the globe so does the interest from scammers to get easy money increase. New methods are devised with an aim to take out every penny from your pocket in exchange for a non-existent service.

Needless to say is that recovery of the lost money is almost impossible since the sellers are not tied to any regulatory body that will go after them. Observe the five methods discussed above and you will be safe from being a victim of forex scam.