If you have been in Forex for any amount of time then you know how very difficult trading can be. Some people have an easier time at it than others, but it is reported and rumored that 95% of traders fail to make money. This means that 95% of traders are losing money on a consistent basis. Some traders even get to the point of breaking even, but usually are not able to go ahead. They’ll have winning trades and losing trades, and oftentimes the losing trades will outnumber the winning trades leaving them with a net loss in the end.

But how can you avoid this problem? How can you trade successfully? Are there some systems that you can trade (that is, methods on how to place trades) that will be successful and allow you to earn profit in the trading business? That’s what we want to take a look at here today. We are going to look at the fundamentals. These are trading strategies that have been proven time and time again.

Just because something is proven doesn’t mean it will work for you though

There is an important point here. A trading system that is successful for one trader may not be successful for another. You can take a winning trader and give them a losing system and chances are they will be profitable even so. On the other hand, you can take a winning system and give it to an unsuccessful trader and oftentimes they will lose money. It is so often the trader not the system that makes the money.

I’ll repeat that just one more time: “It is the trader, not the system, that makes the money.” One of the trainers that I know of continues to remind his students that they will become better traders when they have more experience. And how do you gain experience? The ONLY way to gain experience is by trading. You have to trade in order to gain trading experience. You cannot gain experience by reading a book. You can gain knowledge, yes, but you can never gain experience in the pages of a book. It is as if you were a soldier and had to go to war. Do you gain experience by reading books on war? No. You gain knowledge about certain things by reading but to learn how to shoot a gun you have to shoot a gun. And to get good at hitting targets you have to shoot at targets. You gain experience by doing the thing that you want to learn how to do. You gain skill and become a master by doing that thing hundreds and then thousands and then tens of thousands of times. Remember, no master traders were born in a month.

How do traders trade?

Many traders prefer to execute Forex trades automatically, using automated or semi-automated MT4 Trading Apps and products, such as the MT4 trade copy program. Regardless of whether you want to use an automated trading platform or prefer trading manually, it is important that you define your trading strategy before taking the plunge. Read this article to learn about the four most simple yet effective Forex trading strategies.

Many other traders will preferred to use trade assistance which may alert them to profitable trade opportunities, while other people prefer 100% manual trading. It really doesn’t matter which type of trader you are—what matters is what trades you are taking. It comes down to your system, yes, but more so it is a result of you as a trader being able to make the right decisions at the right times. After all, the market will usually either go up or down or sideways. This is only three directions.

Up, down, sideways. That means you have one of three choices. You can either go along and buy, or you can go short and sell, or you can remain out of the market when it is going sideways. That’s one of three decisions that need to be taken at all times. Most new traders are in the market when they shouldn’t be.

Let’s take a look at what works in the Forex marketing, and what you, with some practice and experience, can use to make money.

Four Simple Forex Trading Strategies that Work

Here are some four Forex trading strategies (including a special extra strategy at the end) to choose from. But keep in mind that these are not the only strategies that are out there. Far from it in fact! There are hundreds of strategies and hundreds of permutations to each strategy. Often times a successful trader will take a strategy and then tweak it to make it their own.

Trend line trading

When the market shows a consistent price movement in a certain direction, you can use trend line to develop your trading strategy. A trend line is an imaginary line that connects three or more consecutive low prices with a straight line. If you detect this type of trend line, the best option would be to wait till the price fall to touch the trend line before you make a trade. There is a strong reason to believe that the price would move upwards again very soon. And if that happens, you get a chance to earn a profit. If, however, the price falls below the line, it would be best to exit the trade immediately.

Some traders also prefer to enter the market when a price breaks the trendline and closes on the other side.

Moving average line trading

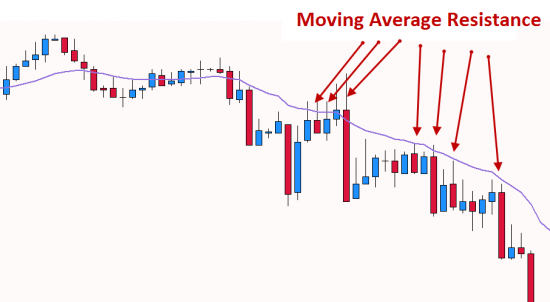

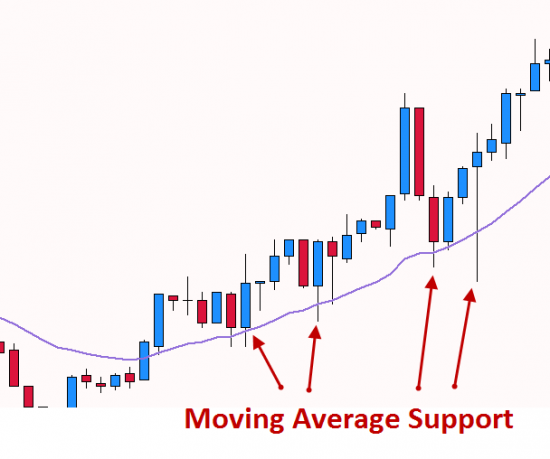

With these images we’re looking at a 21EMA line (exponential moving average) and standard candlestick bars. You can see how the price will often come close and touch the 21EMA before bouncing off and resuming in its original direction. This is a standard in trading and you can see this idea working on all timeframes from 1-minute all the way up to 1-month charts.

This is a line that connects average prices over a long period of time. This line helps you gain an insight into the market’s price fluctuation trends. You can then compare real price movements with the moving average, and speculate fluctuations in foreign currency exchange rates accordingly. When the price moves up and crosses the moving average line, it simply means that the market is gaining momentum, and this might be a good time for you to trade.

Here are two very good examples that will help you understand what trendline trading is all about. The first example illustrates trendline resistance and the second chart shows trendline support.

You can see in these illustrations that the moving average line is a good source of both support and resistance, depending on which way the market is moving. In an uptrend price is going to be above the 21EMA in most cases, while in a downtrend the price is going to be found below the 21EMA. The stronger the move the more below or above the EMA price will be.

One useful way to help determine whether a market is trending or not is to look at the relationship between price action/the candles on the chart and the exponential moving average line. You can also use the slope of the EMA line to help determine the strength of the price movement. If you have a flat EMA line, for example, chances are high that you are looking at a flat market or a range-bound market.

But if you see a nice slope in either direction of the 21EMA line, like in these examples, then chances are high that you’re looking at a nice trending markets. You can use this information to help improve your trading, regardless of what method you use. Since most successful trading is done in a trend, or as a pullback to a trend, using something like an EMA line can be extremely helpful for your trading and for helping you to identify good entry points.

The idea with both of these is to wait for price to come near the moving average and then trade a bounce off of it (or a break). If price breaks the EMA line for enough time then chances are you have a trend reversal. The EMA will subsequently reverse direction and begin to follow price if the EMA break and price movement is sustained.

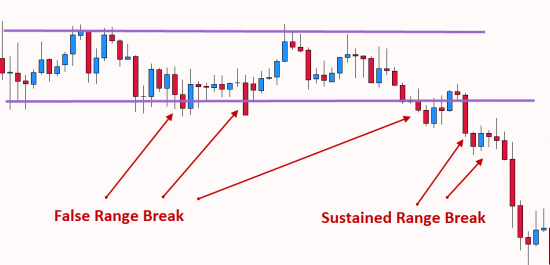

Breakout strategy

Foreign currency exchange prices usually keep moving up and down within a range. However, due to political or economic reasons, the price of a currency may suddenly break out of its usual range and start moving in a certain direction. When that happens, you can expect the price to continue to move in the same direction for quite a long period of time. This would be a perfect time to trade in the Forex market, since you can predict the price movement more confidently.

You could place pending orders at the high and low prices of a specific time range in the markets, like for example, previous trading session’s. Many traders find Range Box Trader app useful when trading such breakouts.

Day Trading

This strategy is especially useful for beginners. Trading within the same day ensures that you don’t lose a large amount of money on a trade. Holding a trade for a long time is not recommended for beginners because it increases the risk of a big loss. Initially, it would be best to invest in multiple short trades, rather than investing in one trade for a long period of time.

A special note here is that day trading is not the same as using Daily candlestick charts. Day trading simply refers to shorter term trades that might be anywhere from a few minutes to a few hours in length.

Different traders believe in different timeframes. Some traders, known as scalpers, will aim to enter the market generally on short term timeframes like the 1 minute or 5 minute charts and take a quick 5-25 pips. This type of quick-action scalping trading is not generally advisable for new traders as the price of a pair can move quite rapidly and losses can come quite quickly if you’re on the wrong side of a trade. It is entirely possible as well to place the trade in one direction only to have the market go against you—taking out your stop loss—and then resuming on in the original direction that you traded. This phenomenon is often one of the most frustrating parts of trading. We as traders see our stop loss hit—sometimes almost to the pip—just for price to reverse and then go on to hit what would’ve been our take profit level. Of course we’re not able to enjoy that take profit level because our trade was stopped out previously.

And what is a solution to this? Do we trade with a larger stop loss the next time? It is possible, but it might be more dangerous. It is always good to trade with a solid risk parameters. Most traders like to go for a certain ratio of a trade, such as a one-to-one, also displayed as 1:1, risk to reward ratio. What this simply means is that the amount they are risking on a trade is the exact same as what they hope to gain from the trade. In a perfect world this would mean that you can win just 51% of your trades and still be profitable. This is not take into account the spread that your broker charges, and this is where some traders get into a lot of trouble. They think their trading a certain risk percentage, and they are looking for a certain risk and reward ratio, but they are not taking into account the spread their being charged from their broker. This bread can often skew the numbers so watch out for this issue in your own trading.

Note: This issue really isn’t a problem if you trade higher timeframes and your take profit levels are greater than 50 pips. However, if you’re doing any type of scalping trading, the spread you pay to the broker becomes incredibly important, and can even make the difference between profitability and an overall loss to your account equity.

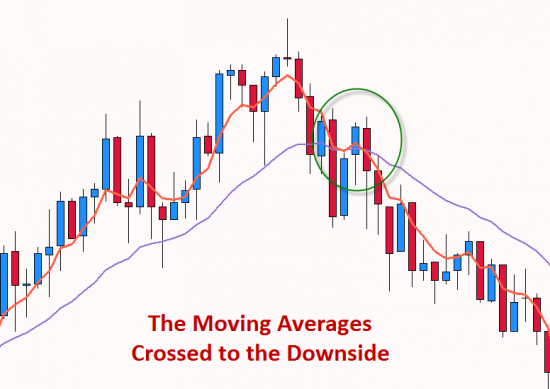

Bonus strategy: moving average crosses

One of the most popular strategies for many traders is to observe the cross of a certain pair of simple moving averages or exponential moving averages. In the image below you can see a moving average crossover to the downside. This looks fine and good here in this illustration, but this is a cherry-picked example to help you clearly see a moving average crossover.

Moving average crossovers are usually one of the first places where the new traders will try their hand. There is a great allure that comes with moving average crossovers because there can be any number (thousands) of combinations that traders can use to help identify trends and entry points. Some traders will only use a moving average crossover to help them determine the prevailing short and/or long term trend.

How are you going to use these strategies?

There are so many strategies to trade forex that they cannot even be counted. Every strategy that is out there can also be adapted to the person who is doing the trading. Remember that there is not one strategy that will work for everyone. Each trader and each person has their own personality and will adapt better to one strategy vs. another.

While not advocating jumping around from system to system, it is important to understand that another system out there may be better suited to your personality than the one you’re trading now (if you are experiencing bad results with it). Keep an open mind, but focus on what is working. If you find something that is working for you, don’t switch to something else. Continue to get better at the thing that is working well for you. Remember that mastery does not come in your second month of trading. It also can be said that mastery does not even come in your second YEAR of trading. Mastery, rather, comes after many years of experience.

So how will you use this information wisely? Do any of these strategies help you with what you are currently working on?

If you’re a new trader, then which of these strategies appeal to you and make the most sense? Chances are, if something make sense to you, then you have a good chance of doing well with it. Continue to trade. The only way that you can get better is by trading and studying. You can work with a mentor, a coach or a trading instructor to learn new things and improve your trading.

Speaking about mentors, recently I have been watching lost of free videos from Scott Schubert and I really like how he explains Forex trading and even gives trading strategies that seem to work (been trying few of them the last few weeks). I started to receive his free training videos once I opted in on his Forex Trading Seminar page. He has positive reviews on FPA as well. I did not tried his paid training program, but I have read lots of positive comments about it online.

Conclusion

Just remember that trading knowledge does not equal trading experience nor trading profits. You can owe everything in the world but if you do not apply what you have learned that you will not see profit to your trading account. You will see profit when you apply your strategy and trade according to the rules of your system. The way that you become very good is to continue to trade according to your system. You’ll gain insight and a sixth sense that can help you avoid the bad setups. When you have enough experience you will begin to see your trading with new eyes.

Do you remember the movie The Matrix and how Neo started ‘to believe’ and could then see the Matrix for what it really was? He was able to see a series of numbers permeating everything. And when this happened he had a level of understanding that transcended that reality and gave him a large degree of control over it. The same is true in many ways for your trading success. Right now you may still be inexperienced and new. You do not have “Neo’s eyes” to see the trading charts the way that they really are. You need more experience to help you trade more successfully. The more experience you gain, the better you will be, and there is no other way around it.

I’d like to know what you think of this article and what you are struggling with. Just post your thoughts and comments down below. Let me know what you’re struggling with or if you would like any clarification on the strategies.

10 replies to "4 Simple Forex Trading Strategies"

Wow, you touched a lot of points in this article! I’d add another dimension to your classification adding timeframes (day trading being one of the timeframes).

Take care

Thanks for your suggestion.

Regards,

Rimantas Petrauskas

Thanks Rimantas,

The best summary of the stratagies that I’ve seen so far. Well done!!

Best Regards.

Thanks Dries. Glad you like it.

Regards,

Rimantas Petrauskas

* Exelent

Rimantas Petrauskas.

* Plesae send- your E-mail- I have a nice, back-test..

Luis, I never trust backtest and never will. If you have a forward live test on a demo or real account I will be glad to look at it on Myfxbook.

Thanks

This is a very good summary for me, thanks Rimantas.

🙂

You’re welcome Twoby 😉 Glad you like it.

Rimantas

Hi Rimantas Petrauskas, thanks for the write up; its really impressive but Please is it possible you put it all inside pdf document so that one can read it even when not online,

Hope to hear from you, thanks

You can copy & paste all contents of this article in a MS Word and then save for offline reading 😉